“We anticipate that price growth by the end of the 2024-25 financial year will be slightly stronger than what is expected by the end of the current calendar year, with a shift in the growth profile,” he said. “We expect slowing price growth in several capital cities but an uptick in the larger markets of Sydney and Melbourne.”

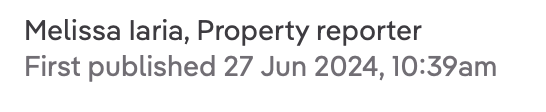

The strongest price growth is forecasted for Perth, with prices expected to rise between 8% and 11% over the 2024-25 financial year. Adelaide is projected to see a price increase of 5% to 8%, while prices in Sydney, Melbourne, and Brisbane are predicted to rise by 3% to 6%.

Growth is expected to be slower in the smaller capitals: Canberra (2% to 5%), Hobart (0% to 3%), and Darwin (1% to 4%).

4o